Unveiling the ICAI New Scheme: A Game-Changer for Aspiring Chartered Accountants

Are you an aspiring chartered accountant? Exciting news awaits! The Institute of Chartered Accountants of India (ICAI) has recently introduced a new scheme that is set to revolutionize the way students pursue their dreams of becoming a chartered accountant. This game-changing scheme is designed to provide a holistic and comprehensive learning experience, equipping students with the necessary skills and knowledge to excel in their professional journey. With a focus on practical training and real-world application, the ICAI New Scheme aims to bridge the gap between theoretical concepts and practical implementation.

By introducing innovative teaching methodologies, advanced technology, and a revamped curriculum, this new scheme promises to produce highly competent and industry-ready professionals. Whether you’re a fresh graduate or a working professional looking to enhance your career prospects, the ICAI New Scheme is the stepping stone you need to unlock a world of opportunities in the ever-evolving field of chartered accountancy. Get ready to embark on an exciting and rewarding journey towards success with the ICAI New Scheme.

So, in this blog post, we?ll explain everything about the ICAI New Scheme 2024, the latest updates and the comparison between the old and new schemes.

You can also check the Important facts about ICAI New Scheme 2023 in our web story.

Important Note:

ICAI has been working on a new scheme and training program in 2023 is set to be implemented from May 2024. So ICAI New Scheme 2024 Or You Can Say ICAI New Scheme 2023 is Game Changer for CA Students.

ICAI New Scheme 2023 is just a proposal, The ICAI is pretty confident about that this scheme will start from may 2024. The Official notification about ICAI New Scheme 2024 will soon be issued ICAI.

Roadmap to become a CA – Under ICAI New Scheme

| About | ICAI New Scheme | ICAI Current Scheme |

|---|---|---|

| Registration for Foundation / appear for 10+2 | Start | Start |

| Appear for Foundation Examination | 4 months | 4 months |

| Study for Intermediate Examination | 8 months | 8 months |

| Articleship | 24 months | 36 months |

| Study for Final Examination | 6 months | – |

| Total period to become ICAI member | 42 months | 48 months |

| Work experience for applying CoP | 12 months | – |

Note: The above neither includes time taken for declaration of results nor waiting time before next exam falls due. However, with the proposal to conduct online examination and / or more than 2 exams in a year, the time for results or next exam due would come down.

- Roadmap to become a CA – Under ICAI New Scheme

- Important Dates for Implementation of New Scheme of Education & Training

- Life Cycle of CA Under ICAI New Scheme

- Short Comparison of Changes In Various Papers of CA Levels

- CA Foundation Under ICAI New Scheme & Current Scheme

- CA Inter Under ICAI New Scheme & Current Scheme

- Self-Paced Online Modules

- CA Final Under ICAI New Scheme & Current Scheme

- Admission & Registration In CA Course Under ICAI New Scheme

- Exams Under ICAI New Scheme

- Practical Training & Industrial Training Under New Scheme of ICAI

- IT Trainings and Soft Skill Courses Under ICAI New Scheme

- What is BAA in CA Course – Exit Route – Business Accounting Associate (BAA)

- Certificate of Practice – COP Under ICAI New Scheme

- Other Important Details About ICAI New Scheme & Course – International Curriculam

- Conclusion

- FAQs Related to ICAI New Scheme 2024

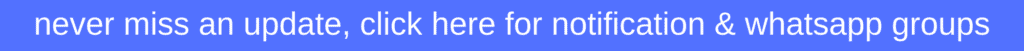

The Path to Becoming a Chartered Accountant (CA): A Detailed Step-by-Step Guide under the ICAI New Scheme 2023

Important Dates for Implementation of New Scheme of Education & Training

| S.No. | Particulars | Date/ Attempt |

| 1. | Last date for Registration in Foundation under Existing Scheme | 1st July, 2023 |

| 2. | Last date for Registration in Intermediate and Final Courses under Existing Scheme | 30th June, 2023 |

| 3. | Date of commencement of Registration and Conversion in Foundation Course under New Scheme | 2nd August, 2023 |

| 4. | Date of commencement of Registration and Conversion in Intermediate and Final Courses under New Scheme | 1st July, 2023 |

| 5. | First Foundation Examination under New Scheme | June, 2024 |

| 6. | First Intermediate and Final Examination under New Scheme | May, 2024 |

| 7. | Last Foundation Examination under Existing Scheme | December, 2023 |

| 8. | Last Intermediate and Final Examination under Existing Scheme | November, 2023 |

| 9. | Last date of commencement of three years Practical Training | 30th June, 2023 |

| 10. | Date of commencement of two years uninterrupted Practical Training | 1st July, 2023 |

Life Cycle of CA Under ICAI New Scheme

Check below the complete step by step guide & details of new scheme proposed by ICAI to become a CA

| Steps | Life Cycle of CA Under ICAI New Scheme |

|---|---|

| Step 1 | Register for Foundation after passing Class 10 (registration valid for 4 years) |

| Step 2 | Appear for Foundation Examination after appearing for 10+2 examination and completion of 4 months from registration (passing marks 50% in each paper) |

| Step 3 | Register for Intermediate Course after passing Foundation Examination / graduate or post- graduate with requisite marks (registration valid for 5 years + 5 years with revalidation) |

| Step 4 | Appear for Intermediate Examination (6 papers ? 2 groups) after completion of study period of 8 months (passing marks 40% in each paper and 50% in each group) Registration for Intermediate Course would also be treated as registered for Business Accounting Associate (BAA) |

| Step 5 | Pass both groups of Intermediate Examination, complete integrated course on Information Technology and Soft Skills and commence articleship |

| Step 6 | Register for Final Course and registration valid for 10 years which can be revalidated after every 10 years |

| Step 7 | Articleship period will be 2 years of which 2nd year can be for industrial training (eligible leave 24 days for 2 years) |

| Step 8 | Undergo Advanced Integrated Course on Information Technology and Soft Skills Course, pass self paced online modules and Complete articleship before appearing in Final Examination |

| Step 9 | Appear for Final examination (6 papers ? 2 groups) after and completion of 6 months from end of articleship (passing marks 40% in each paper and 50% in each group) If unsuccessful, apply for Business Accounting Associate |

| Step 10 | A candidate getting exemption in any paper will need to pass the remaining papers within the next 3 attempts. The exemption can be availed further subject to passing marks of 50% in each paper |

| Step 11 | Pass both groups of Final Examination and apply for ICAI membership. To apply for Certificate of Practice undergo 1 year work experience under a fellow CA in practice |

Short Comparison of Changes In Various Papers of CA Levels

In the below table, You can check the Level-Wise Comparison of CA Foundation, CA Inter & CA Final

| CA Level | Proposed Under New Scheme | Existing Papers/Subjects |

|---|---|---|

| CA Foundation | 4 Papers (Business Correspondence and Reporting) & (Business & Commercial Knowledge) Reduced | 4 Papers |

| CA Inter | Group 1 – 3 Papers Group 2 – 3 Papers Introduction of Self-paced Online Modules – 4 | Group 1 – 4 Papers Group 2 – 4 Papers |

| CA Final | Group 1 – 3 Papers Group 2 – 3 Papers | Group 1 – 4 Papers Group 2 – 4 Papers |

CA Foundation Under ICAI New Scheme & Current Scheme

| Proposed | Current |

|---|---|

| Paper -1 : Accounting | Paper -1 : Principles and Practice of Accounting |

| Paper -2 : Business Laws | Paper -2 : Business Laws and Business Correspondence and Reporting |

| Paper -3 : Quantitative Aptitude – Business Mathematics – Logical reasoning – Statistics | Paper -3 : Business Mathematics and Logical Reasoning and Statistics |

| Paper -4 : Business Economics | Paper -4 : Business Economics & Business & Commercial Knowledge |

- Paper -1: A portion from the subject ?Accounting? at the Intermediate level in the current CA course would be included in the proposed scheme so as to increase the standard of the Foundation level.

- Paper -2: Business Correspondence and Reporting is not being separately included in the new course. Instead, to facilitate students with the requisite communication skills, an online course would be launched on English/Business communication, which would be recommendatory.

- Paper -2: A dedicated 100 marks descriptive paper against 60 marks paper (in the current CA course) is proposed for ?Business Laws?, which would help assess communication skills in addition to understanding laws.

- Paper -4 : A dedicated 100 marks paper as against 60 marks paper (in the current CA course) on ?Business Economics? will include topics from the subject ?Economics from Finance? at the Intermediate level in the current CA course.

- Paper -4 : Students would get exposure of Business and Commercial Knowledge as part of their practical training in a more integrated manner and is therefore excluded in the new course.

CA Inter Under ICAI New Scheme & Current Scheme

| Proposed | Current |

|---|---|

| Paper -1 : Advanced Accounting | Paper -1 : Accounting Paper -5 : Advanced Accounting |

| Paper -2 : Corporate laws | Paper -2 : Corporate and other laws |

| Paper -3 : Cost and Management Accounting | Paper -3 : Cost and Management Accounting |

| Paper -4 : Taxation | Paper -4 : Taxation |

| Paper -5 : Auditing and Code of Ethics | Paper -6 : Auditing and Assurance |

| Paper -6A : Financial Management (50 Marks) Paper -6B: Strategic Management (50 Marks) | Paper -7: Enterprise Information Systems & Strategic Management Paper -8 : Financial Management & Economics for Finance |

- Instead of two papers on accounting (in the current CA course) there would be a single paper ?Advanced Accounting?. However, there will be no reduction in the content which is covered in two papers in the present scheme vis-?-vis one paper in the proposed scheme (some portion will be moved to Foundation level).

- The paper on ?Corporate Laws? would cover The Companies Act in its entirety, since ?Business Laws? is already covered at Foundation level through a 100 mark paper.

- Instead of a paper on ?Enterprise Information Systems? at this level, information technology education is being integrated with subjects at the Final level.

Self-Paced Online Modules

Self-paced online learning modules encompassing different fields are being introduced which students can learn and qualify at their own pace after qualifying Intermediate examination and before writing Final examination. Such creative combination of disciplines would inculcate cross-disciplinary thinking and facilitate innovative reasoning.

| Set A (compulsory) | Set B (compulsory) | Set C (any one to be selected) | Set D (any one to be selected) |

|---|---|---|---|

| Economic Laws | Strategic Cost Management and Performance Evaluation | Specialisation Elective | Incorporating Multi- disciplinary approach envisaged in NEP, 2020 |

Set A (compulsory) – Economic Laws

- Foreign Exchange Management Act, 1999

- Insolvency and Bankruptcy Code, 2016

- Prevention of Money Laundering Act, 2002

- Competition Act, 2002

- Securitization and Reconstruction of Financial Assets

- Enforcement of Security Interest Act, 2002

- Real Estate (Regulation and Development) Act, 2016

- Prohibition of Benami Property Transactions Act, 1988

Set B (compulsory) – SCMPE (Strategic Cost Management and Performance Evaluation)

Strategic Cost Management and Performance Evaluation

Set C (compulsory) – Specialization Elective

- Risk management

- Integrated and Sustainability Reporting

- Government Accounting and Public Finance

- Introduction to Digital Ecosystem and Transformation

- International Taxation

- Arbitration, Mediation and Conciliation

- Forensic Audit

- Financial Services and Capital Markets

- Valuation

- Forex and Treasury Management

Set D (compulsory) – Incorporating Multidisciplinary approach envisaged in NEP, 2020

- Constitution of India

- Psychology (including self-awareness)

- Entrepreneurship (to include MSMEs & Start ups)

- Communication (to include advocacy)

- Philosophy

CA Final Under ICAI New Scheme & Current Scheme

| Proposed ICAI New Scheme | Current ICAI Scheme |

|---|---|

| Paper -1 : Financial Reporting | Paper -1 : Financial Reporting |

| Paper -2 : Advanced Financial Management | Paper -2 : Strategic Financial Management |

| Paper -3 : Advanced Auditing & Professional Ethics | Paper -3 : Advanced Auditing and Professional Ethics |

| Under Self-Paced Online Mandatory Module | Paper -4: Corporate and Economic Laws |

| Under Self-Paced Online Mandatory Module | Paper -5: Strategic Cost Management and Performance Evaluation |

| Paper -4 : Direct Tax Laws and International Taxation | Paper -7 : Direct Tax Laws and International Taxation |

| Paper -5 : Indirect Tax Laws | Paper -8 : Indirect Tax Laws |

| Paper -6 : Integrated Business Solutions (Multi-disciplinary case study with Strategic Management) | Paper -6 : Electives (1 out of 6) Paper -6A : Risk Management Paper -6B: Financial Services and Capital Markets Paper -6C : International Taxation Paper -6D : Economic Laws Paper -6E : Global Financial Reporting Standards Paper -6F : Multidisciplinary Case Study |

Some Important Notes

- Ethics and Information Technology to be integrated with the curriculum of all subjects at the Final Level.

- Multi-disciplinary case study is being made compulsory, and the same would be integrated with strategic management. This paper is necessary to assess the student?s ability to integrate the concepts and provisions across different subject areas, analyse them and apply them in addressing issues and solving problems in a multi-disciplinary case study involving strategic decision making.

- The current elective papers like risk management and financial services and capital markets would be included in self-paced online module [SET C], out of which students can opt one based on their desired area of specialization.

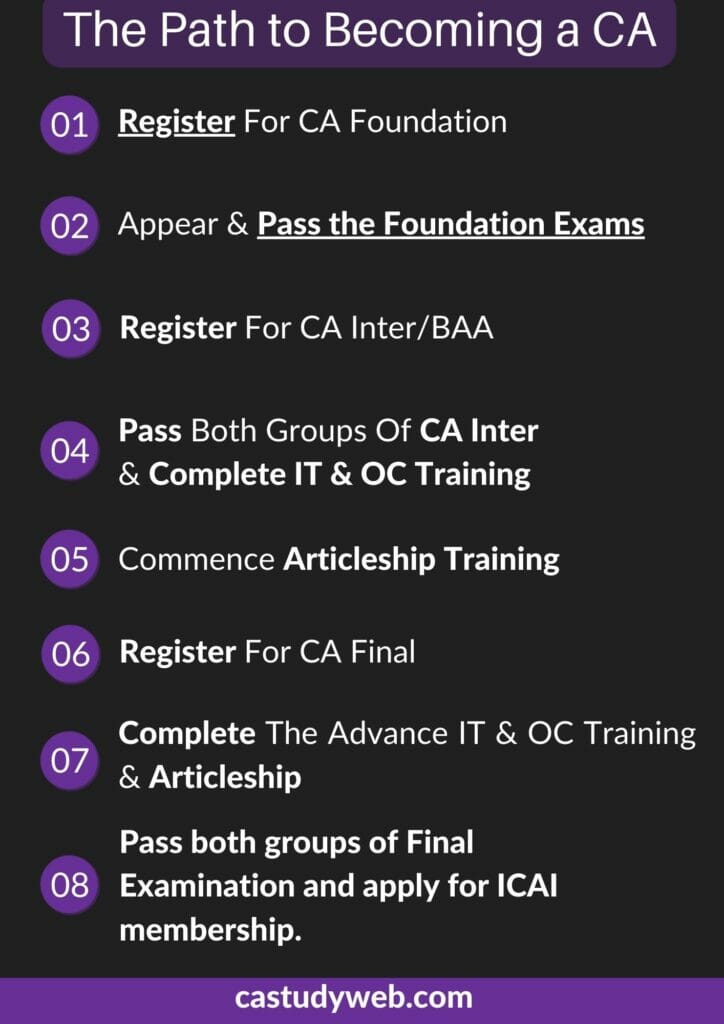

Admission & Registration In CA Course Under ICAI New Scheme

Now we will check how we can take admission under CA Course Under New Scheme of Education

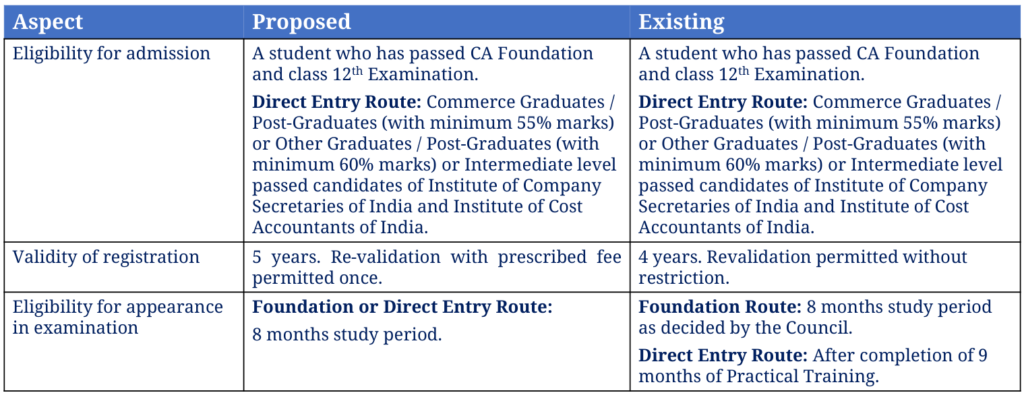

CA Foundation Registration & Eligibility Under New Scheme

Some Important notes

- If a candidate is not able to clear Foundation Exam within 4 years of registration, he can opt for alternative route of direct entry to Intermediate Course subject to fulfilling stipulated conditions.

- Four Months Study Period has been specified and cut-off dates i.e. 1st January and 1st July have been removed. This will also enable holding of Foundation Exams more than two times in a year.

CA Inter Registration & Eligibility Under New Scheme

Some Important notes

In case of graduates/ post-graduates, students can provisionally register in the Final year of graduation/ post-graduation and the 8 months study period would be counted from the date of provisional registration. They should have, however, passed graduation/ post graduation, as the case may be, with prescribed minimum marks, at the time of making an application for appearing in Intermediate examination.

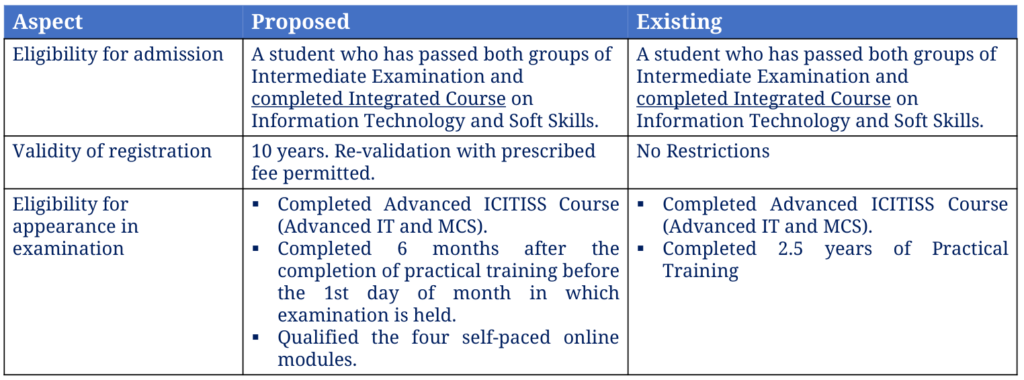

CA Final Registration & Eligibility Under New Scheme

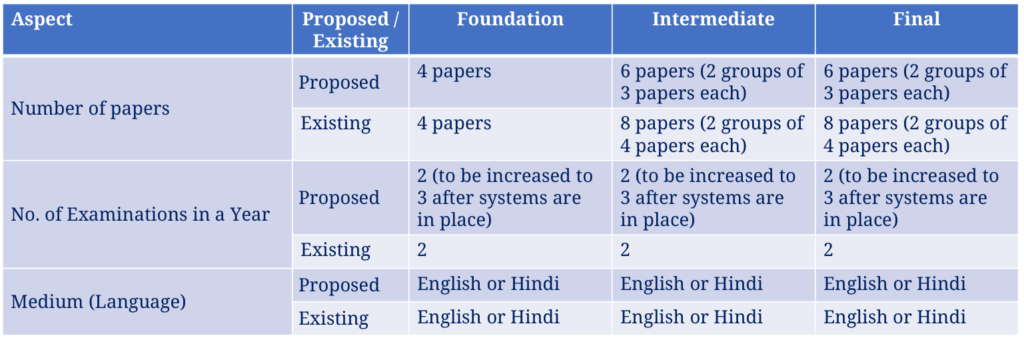

Exams Under ICAI New Scheme

Here you can check each and every exam related detail under New Scheme Proposed by ICAI, Like Number of Papers Under New Scheme, No. of Examination in a year And the medium of exams (Hindi Or English)

Detailed Chart Showing Exams Related Details

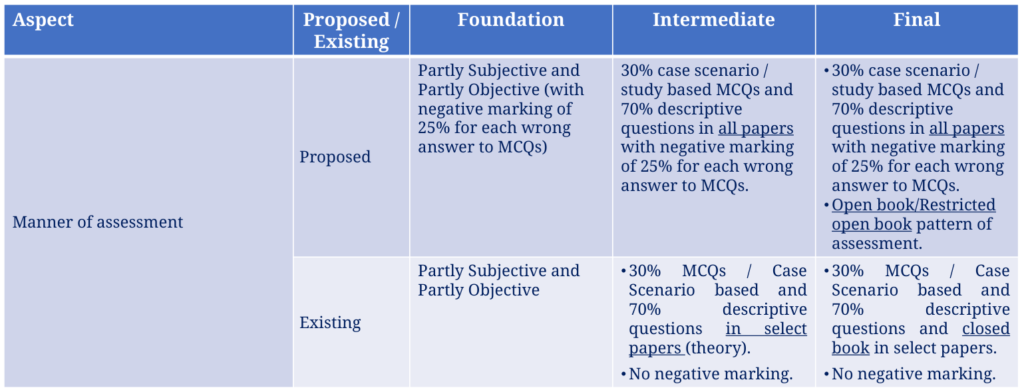

Manner of assessment under new ICAI Scheme

Negative marking would prevent students from resorting to guess work while answering questions. They would strive to improve their preparation and hone their application skills in order to answer correctly in the MCQ based papers.

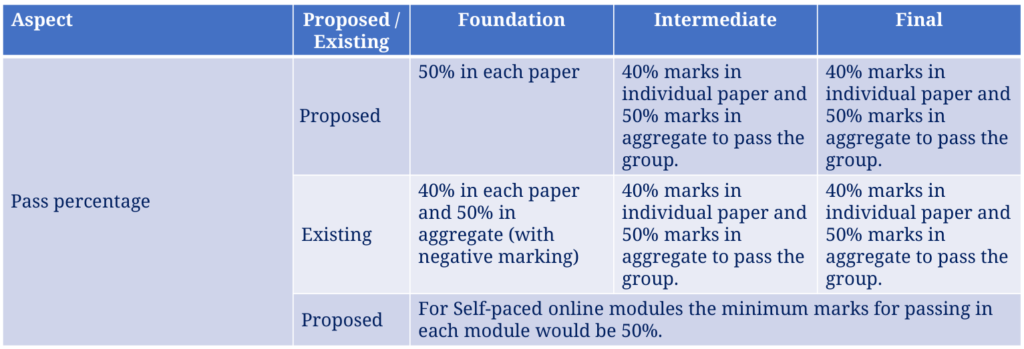

Pass percentage and result under new Scheme of ICAI

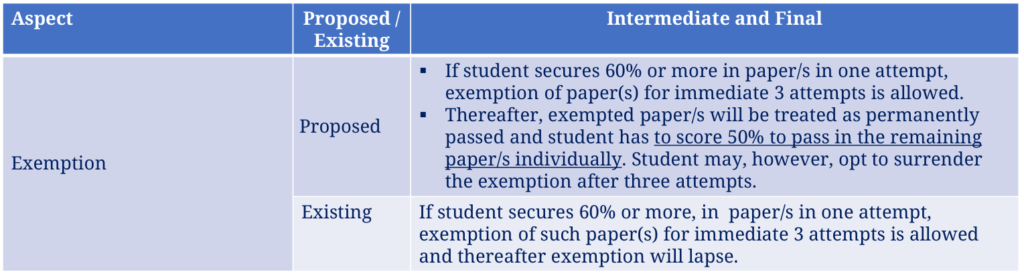

Exemption under new Scheme of ICAI

Exemption obtained in any paper would not lapse even after three attempts. However, the candidate would be required to score 50% each in the remaining paper(s) (instead of 40% marks in individual paper and 50% marks in aggregate, as at present). Student may, however, opt to surrender the exemption after three attempts.

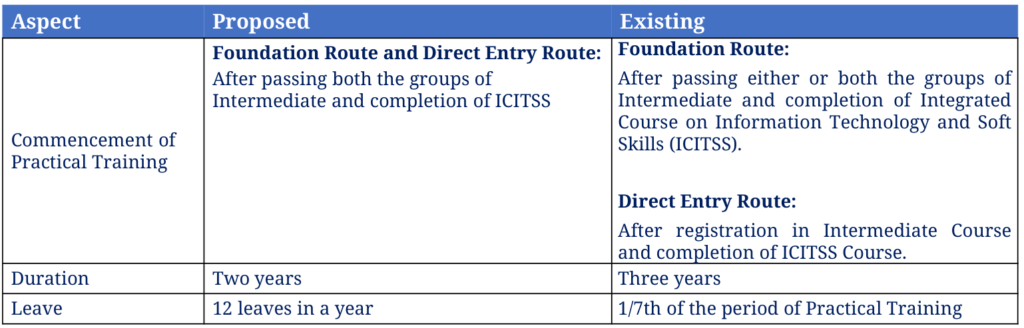

Practical Training & Industrial Training Under New Scheme of ICAI

Practical Training to commence only after passing both the groups of Intermediate in order to have exam free and seamless effective training, where a student can focus completely on his practical training.

In order to ensure seamless and focussed practical training, the period of training would be an examination free period of two years. The student can appear in Final examination after completion of 6 months from the end of practical training period.

Since there will be no exams during the two years of practical training, therefore, number of leaves have been restricted to 12 days in a year.

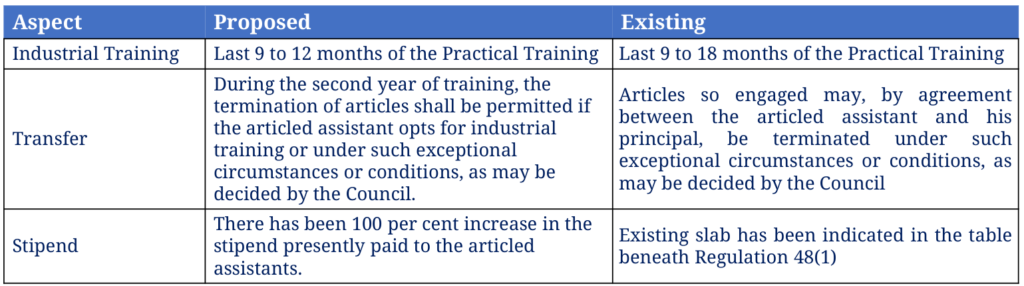

Consequent to the changes in duration of the practical training, industrial training would be permitted in the last leg of practical training for a period of 9 months to 12 months.

Since industrial training is permitted in the last 9 ? 12 months of practical training period of two years, the requirement for transfer has been accordingly modified.

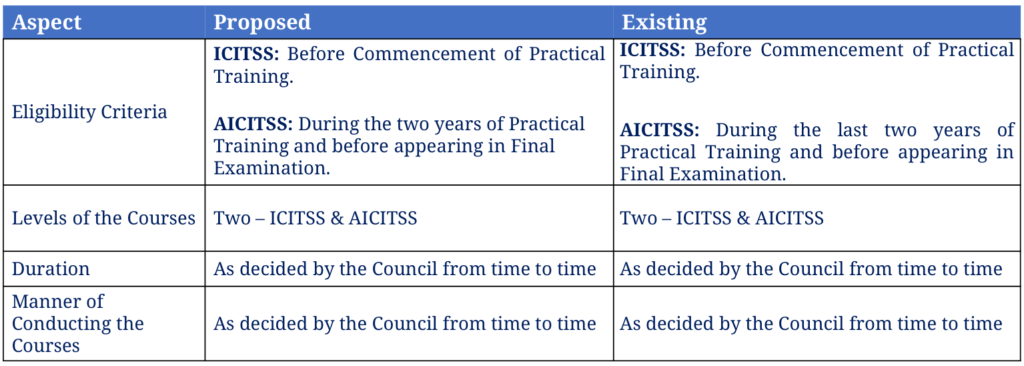

IT Trainings and Soft Skill Courses Under ICAI New Scheme

Here you can check the Complete details of ICITSS, AICITSS or you can say, IT & Advance IT Training

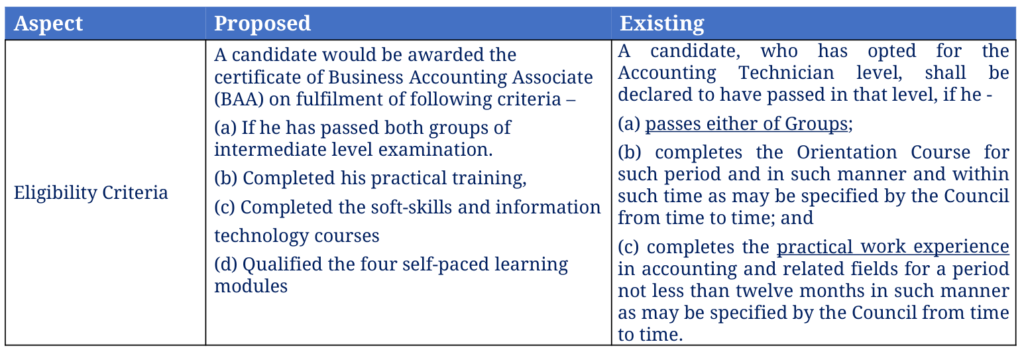

What is BAA in CA Course – Exit Route – Business Accounting Associate (BAA)

A BAA certificate holder would possess the requisite accounting and technology skills since he would have qualified both groups of the intermediate examination; undergone the stipulated two years articleship training; completed the soft-skills and information technology courses and qualified the four self-paced online modules. This would cater to the needs of the industry by providing quality accounting and financial support staff and help the student in building his career.

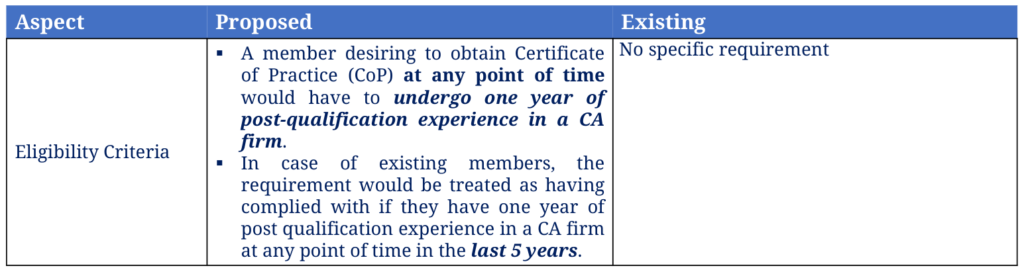

Certificate of Practice – COP Under ICAI New Scheme

A one year post qualification experience is mandated for those applying for COP. Also, members who are in industry and desire to shift to practice would also be required to have a one year experience in a CA firm before they apply for COP.

This is to ensure that they acquire the requisite professional skills required to undertake practice, especially in relation to provisions of law and standards, when they desire to opt for practice.

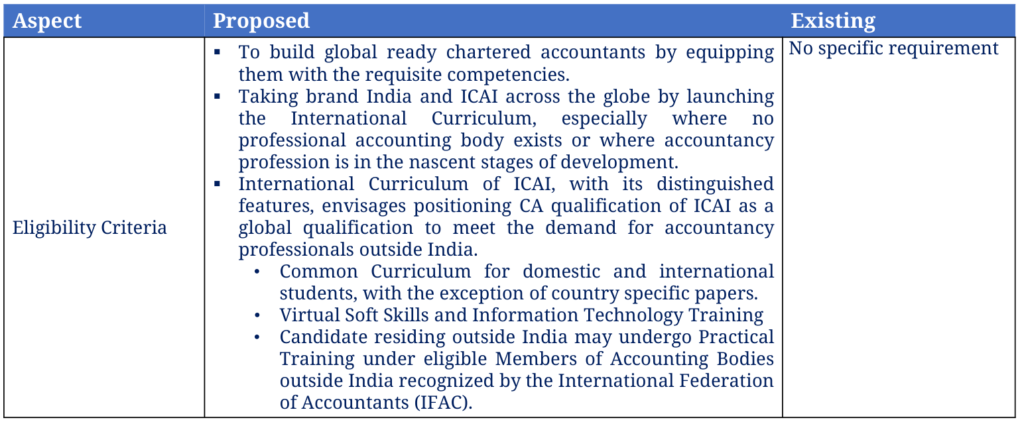

Other Important Details About ICAI New Scheme & Course – International Curriculam

Important links and contacts

Conclusion

This is all about the CA New scheme of education and training proposed by ICAI recently and which will be applicable from May 2024 exams. The new course will benefit future Chartered Accountants as it will prepare them for the International markets.

FAQs Related to ICAI New Scheme 2024

How many Papers are there in CA Foundation Course ?

The?CA Foundation new syllabus 2023?is as follows:

Paper ? 1: Accounting (100 Marks)

Paper ? 2: Business Laws (100 Marks)

Paper ? 3: Quantitative Aptitude (100 Marks)

Business Mathematics

Logical Reasoning

Statistics

Paper ? 4: Business Economics (100 Marks)

What is the examination pattern in CA Foundation Course?

In the new scheme, students have to get 50% marks to crack the CA Foundation exams, and there will be a negative marking of .25 for every wrong MCQ answer.

When will the new ICAI scheme be implemented?

The new ICAI scheme is scheduled to be implemented in May 2024. Students who are currently enrolled in the existing three-tier structure will be allowed to complete their studies under the old scheme.

How many Papers are there in CA Inter Course In ICAI New Scheme?

There are total 6 Papers Under New Scheme. Paper 1 & Paper 5 Are Merged Into Only 1.

Paper -6A : Financial Management (50 Marks)

Paper -6B: Strategic Management (50 Marks)

Are also merged into 1

How many Papers are there in CA Final Course In ICAI New Scheme?

There are total 6 Papers Under New Scheme.

What are Self-Paced Online Modules In ICAI New Scheme?

Self-paced online learning modules encompassing different fields are being introduced which students can learn and qualify at their own pace after qualifying Intermediate examination and before writing Final examination. Such creative combination of disciplines would inculcate cross-disciplinary thinking and facilitate innovative reasoning.

What is the duration of Practical Training in New Scheme?

How many leaves are available in ICAI New Scheme?

Since there will be no exams during the two years of practical training, therefore, number of leaves have been restricted to 12 days in a year.

Stipend of CA Article in New Scheme?

Many students often complain that their CA articleship stipend is low. So, ICAI has decided to?increase the stipend by 100%.

When can I register for the Final Course?

Pass both groups of Intermediate Examination, complete integrated course on Information Technology and Soft Skills and commence articleship

What are the Requirements to Enter the CA Final Examinations

Undergo Advanced Integrated Course on Information Technology and Soft Skills Course, pass self paced online modules and Complete articleship before appearing in Final Examination.