Hello Everyone,

CA Study has come up with a series of EXAM ORIENTED articles that will help students understand and solve typical topics from the various chapters. This article is intended for CA Final Group I Students. The topic covered is CA Final FR FINANCIAL INSTRUMENTS – DERIVATIVES (OPTIONS, SWAPS, FORWARD & FUTURES). We are not going to cover basics or easy topics or content. Hence the article is intended for those who have at least gone through this chapter once either in class or self.

Since this is a new initiative. Feedback matters the most. Students are requested to kindly drop a comment in the comment box at bottom of this article with their views/ suggestions etc. We will be happy to incorporate the same in our future articles. 🙂

CA Final FR FINANCIAL INSTRUMENTS – Derivatives

Derivatives – Forward & Futures

Background:

Derivatives (which derives it?s value) definition:

Instruments whose value changes in response to the underlying.

No or very little Investment is required in such instruments.

Settlement is at future date.

Derivatives can be Financial Liability or Financial Asset. CA Final FR FINANCIAL INSTRUMENTS

No physical delivery takes place.

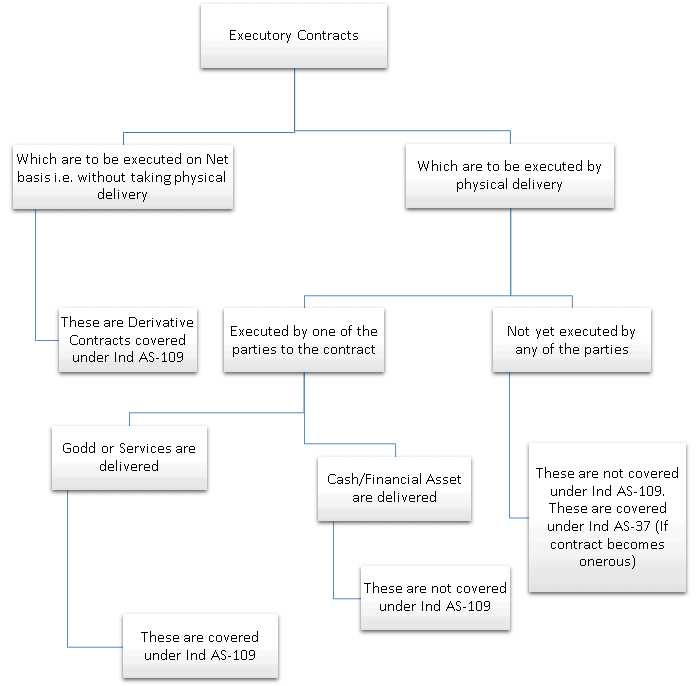

Contracts :

Note: Whether contracts can be settled on net basis or delivery basis can be checked by past history of similar contracts or management view. (In November 2015, 4 marks was asked from this part) Nature or Derivatives:

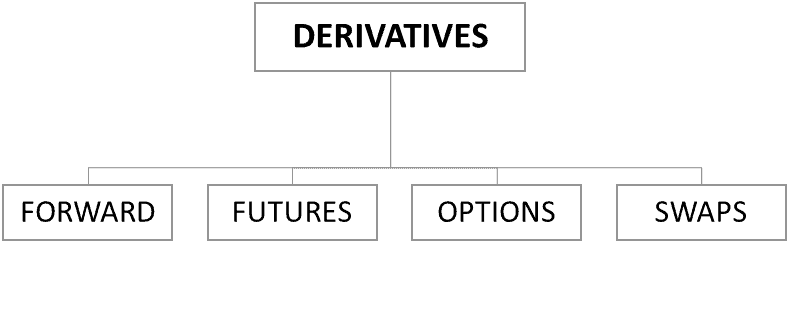

Derivatives can be in nature of Forward, Futures, Options and Swaps.

Derivatives – Forward & Futures

NATURE OF DERIVATIVES

A. Forward Transactions

Two parties irrevocably agree to trade on any asset at future date, for price and quantity agreed today.

It is a type of hedging technique to minimise the risk.

Here, Seller (S) is said to be in Short position and Buyer (B) is said to be in Long Position.

Example: S and B agree today i.e. 01.11.2020 to do trade on 01.04.2021 at Rs. 100 per $. Here, Rs. 100 per $ is Forward Rate. Spot Rate is Rs. 95 per $. B can buy $ at Rs. 100 per $ on 01.04.2020 irrespective of the price prevailing on 01.04.2020.

B. Futures

Future contract is futures exchange to buy or sell underlying instrument and requires Initial Margin.

Buyer (B) is said to be Long position and Seller (S) is said to be in Short position.

?B? and ?S? enters into a future contract today.

?B? will buy and make payment at future date.

Example: S and B enters into futures contract today i.e. 01.11.2020 to purchase shares on 01.04.2021 at Rs. 573.15 (contract price). On 01.04.2021, price of the shares in the future segment is Rs. 600. B is in profit of Rs. 26.85 (Rs. 600 – Rs. 573.15). CA Final FR FINANCIAL INSTRUMENTS

Accounting Treatment:

Ind AS-109 requires derivatives to be recognized as per Fair Value Through Profit or Loss ?FVTPL?. It means gain or loss on derivatives is recognised in Balance Sheet through the Profit and Loss Account. Let?s further study the Accounting Treatment of Forward and Futures.

Derivatives – Forward & Futures

IMP QUESTIONS FOR PRACTICE

Question 1

On 1st January 20X1, SamCo Ltd. agreed to purchase USD ($) 20,000 from JT Bank in future on 31st December 20X1 for a rate equal to Rs. 68 per USD. SamCo Ltd. did not pay any amount upon entering into the contract. SamCo Ltd. is a listed company in India and prepares its financial statements on a quarterly basis.

Following the principles of recognition and measurement as laid down in Ind AS 109, you are required to record the entries for each quarter ended till the date of actual purchase of USD.

For the purposes of accounting, please use the following information representing marked to market fair value of forward contracts at each reporting date:

As at 31st March 20X1 – Rs. (25,000)

As at 30th June 20X1 – Rs. (15,000)

As at 30th September 20X1 – Rs. 12,000

Spot rate of USD on 31st December 20X1 ? Rs. 66 per USD

(Similar type of question asked in November 2010 for 8 marks).

Solution :

Question 2

Mr. A enters into a future contract (long) for 100 shares @ 300 each. He paid Rs.5000 initial margin. Date of contract is 27.7.2018. Settlement date is 29.9.18

Price of share on subsequent days were as follows CA Final FR FINANCIAL INSTRUMENTS

? 27.07.2018 – Rs.315

? 12.08.2018 – Rs.350

? 16.08.2018 – Rs.340

? 31.08.2018 – Rs.290

? 29.09.2018 – Rs.310

Pass Journal Entries.

Solution :

| Date | Particulars | Dr. | Cr. |

| 27.07.2018 | Initial Margin Account Dr. To Bank Account | 5,000 | 5,000 |

| 27.07.2018 | Bank Account Dr. To MTM @ (315-300)*100 | 1,500 | 1,500 |

| 12.08.2018 | Bank Account Dr. To MTM @ (350-315)*100 | 3,500 | 3,500 |

| 16.08.2018 | MTM @ (350-340)*100 Dr. To Bank Account | 1,000 | 1,000 |

| 31.08.2018 | MTM @ (340-290)*100 Dr. To Bank Account | 5,000 | 5,000 |

| 29.09.2018 | Bank Account Dr. To MTM @ (310-290)*100 | 2,000 | 2,000 |

| 29.09.2018 | Derivative Financial Asset Account Dr. To Profit and Loss Account (Gain) @ (310-300)*100 | 1,000 | 1,000 |

| 29.09.2018 | MTM Dr. To Derivative Financial Asset Account | 1,000 | 1,000 |

| 29.09.2018 | Initial Margin Account Dr. To Bank Account | 5,000 | 5,000 |

Derivatives – Options

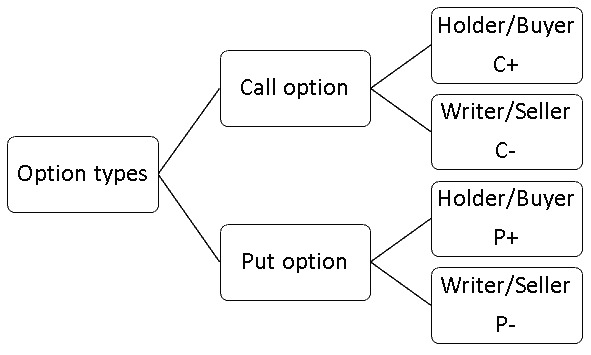

Background:

An option is the right, but not the obligation, to buy or sell something at a stated (Future) date at a predetermined price (Exercise Price).

The person who gets the right is the ?Buyer? or ?Holder?.

The person who grants the right, and becomes an obligor is the ?Seller? or ?Writer?.

Option to buy something is a Call Option.

The option to sell something is a put option. CA Final FR FINANCIAL INSTRUMENTS

To get the right buyer pays a price to the seller upon contract inception known as option premium.

Such premium becomes the price(value) of the option.

Varieties of Option – European and American

European Option-The option holder can only exercise his right on the expiration date.

American option-He can exercise his right anytime between the purchase date and the expiration date.

On the stated date, the option can be ?at the money?, ?in the money? or ?out of the money?. CA Final FR FINANCIAL INSTRUMENTS

| At the money | Stated date Market Value of underlying = Exercise Price of option. No profit/No loss. |

| In the Money | For a Call Option: Stated date Market Value of underlying > Exercise Price of option. For a Put Option: Stated date Market Value of underlying < Exercise Price of option. A profit position-Buyer will Exercise the option. |

| Out of the Money | For a Call Option: Stated date Market Value of underlying < Exercise Price of option. For a Put Option: Stated date Market Value of underlying > Exercise Price of option. A loss position-Buyer will not exercise the option. Option simply expires. |

Whether the Contract is favourable or unfavourable will be decided from holder point of view. Since he can take the decision as to exercise the option or not.

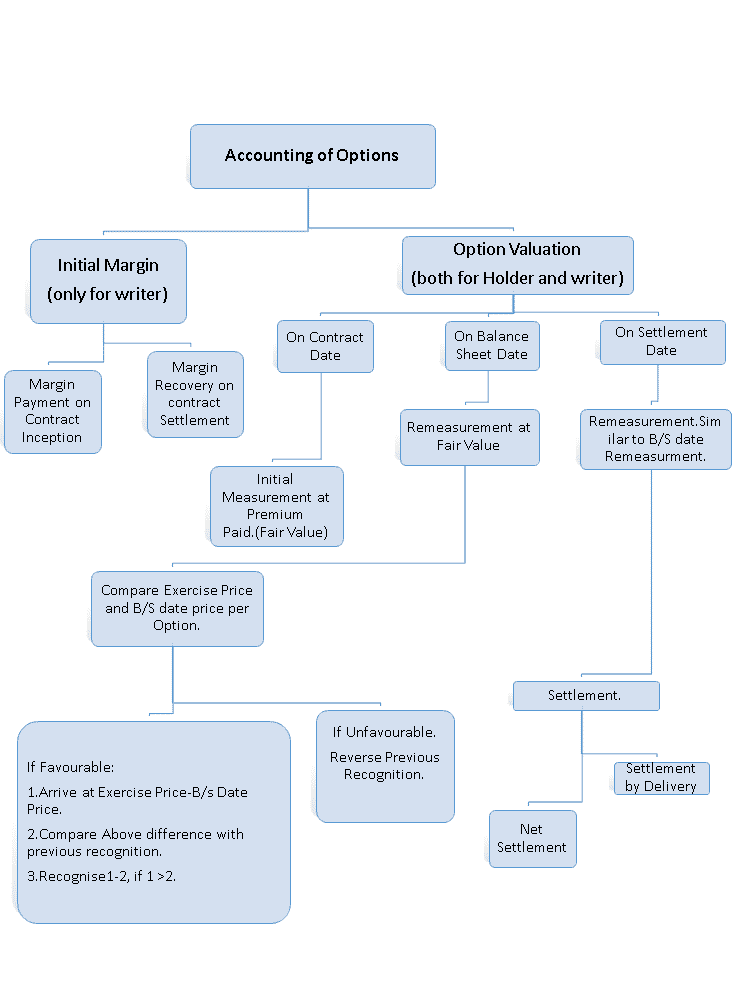

Seller of the option, since the future obligation lies on him, needs to pay some initial Margin on the contract inception. It will be recovered by him once the contract expires or settles. CA Final FR FINANCIAL INSTRUMENTS

Derivatives – Options

Core Explanation :

| PARTICULARS | C+ | C- | P+ | P- |

| BUYER/SELLER | BUYER | SELLER | BUYER | SELLER |

| RIGHT TO | ||||

| ->BUY | ->SELL | |||

| ->ENJOY UPSIDE | ->ENJOY DOWNSIDE | |||

| OBLIGATION TO | ||||

| ->SELL | ->BUY | |||

| ->SUFFER UPSIDE | ->SUFFER DOWNSIDE | |||

| PAYOFF IS | INFLOW | OUTFLOW | INFLOW | OUTFLOW |

| PREMIUM IS | OUTFLOW | INFLOW | OUTFLOW | INFLOW |

Derivatives – Options

Tricks for Easy Understanding :

Try decoding the lengthy lines into short forms for quick writings-

C+270@25(LZ 400).IM 50. CA Final FR FINANCIAL INSTRUMENTS

It means a Person is a Call Option Holder(C+), the Exercise price of the contract is Rs 270/unit, paid a premium of Rs 25/unit to the writer, a total number of units entered(Lot Size) were 400 and the initial margin deposited by the Call Option writer is Rs 50/unit.

P–200@30(LZ 100).IM 60.

It means a Person is a Put Option Writer (P–) exercise price per unit is Rs200, received a premium of Rs 30/unit from the holder, total number of units entered(Lot Size) were 100 and the initial margin deposited by him is Rs 60/unit.

Avoid mis-interpretating the question.

For Example,

A buyer buys a stock option of Manjunath Garments Ltd on 30th August 2020 with a strike price of Rs.145 per unit to be expired on September 30, 2020. The premium is Rs.10 per unit and the market lot is of100. The margin to be paid is Rs.20 per unit.

Show, how the transactions will appear in the books of the seller, when:

1. The option is settled by delivery of the Asset, and

2. The option is settled in cash and the Index price is Rs.160 per unit.

In the above question, students may get confused as to whether it is a call option or a put option, but there is a hint in the question itself, it asks for transactions in books of the seller when the option is settled by cash or delivery. It means that suppose the contract gets settled by delivery of underlying, seller will deliver the underlying asset upon settlement. When the seller Is liable to deliver the underlying asset it is a clear case of the call option. In put option, Seller is only liable to receive the delivery of asset and pay cash. CA Final FR FINANCIAL INSTRUMENTS

To decide whether the option is favourable or unfavorable, always go with the view of the option holder.

You may feel difficult while calculating the fair value of options. The option is the only derivative instrument that has fair value upon initial recognition. The total amount of premium paid for getting the option will become its fair value on initial recognition. That should be accounted in the books of the holder as payment for a financial asset, in the books of the writer as a receipt for financial liability.

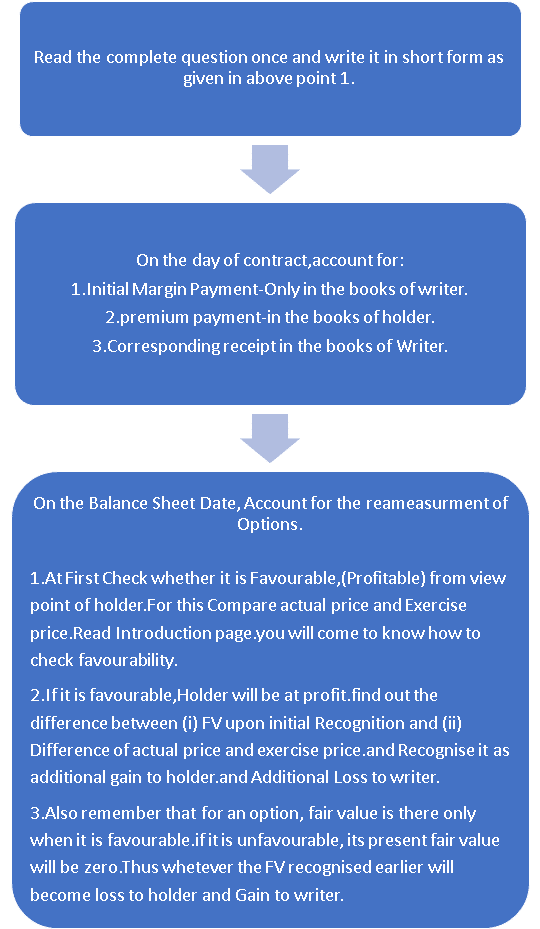

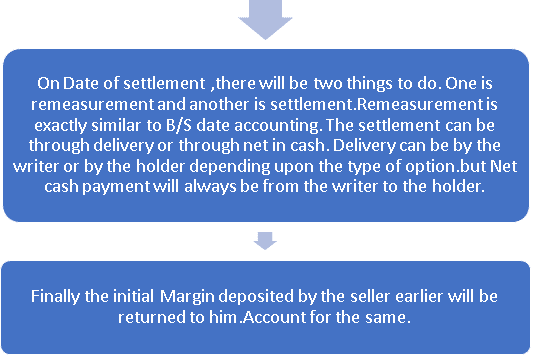

The simple steps that can be followed while approaching any options related questions can be as follows :

Derivatives – Options

Important Questions for Practice

| Question 1. |

| A buyer buys a stock option of Nagu Company Ltd Limited on 30th September, 2012 with a strike price of Rs.160 per unit to be exercised on February 28, 2013. The premium is Rs.10 per unit and the market lot is of 100. The margin to be paid is Rs.30 per unit. |

| Show, how the transactions will appear in the books of the buyer (A) & seller (B), if it is a call & if it is a put option when, the option is settled by delivery of the Asset, and if the option is settled in cash and the Share price on maturity is (i) Rs.150 and (ii) Rs.18 0 per Unit. |

Solution:

Part A- Call Option Rs160@10 (Lot Size 100). Margin Rs 30/Unit.

Part B- Put Option Rs160@10 (Lot Size 100). Margin Rs 30/Unit.

Derivatives – Options

PAST EXAM COVERAGE OF THIS TOPIC

November 2015 – 4 marks.

Derivatives – Swaps

BACKGROUND & CORE CONCEPTS

Swap is contract for exchanging one type of Cash flow or obligation with another type.

There are no Accounting Standards or Guidance Note yet on Swap accounting

The accounting is based on GAAP & Frame work for preparation & Presentation of Financial Statements.

Types of Swaps.

Interest Rate Swap.

Currency Swaps.

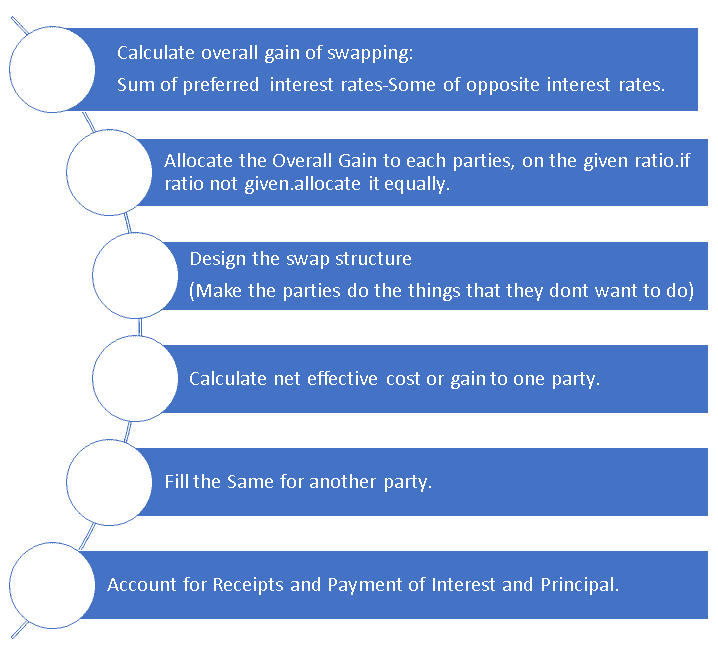

Steps for Swap Accounting

Derivatives – Swaps

IMPORTANT QUESTIONS FOR PRACTICE

| Parties | X | Y |

| Credit Rating | Low | High |

| Parties Preference | Fixed | Fluctuating |

| Rates Offered by the lender | ||

| Fixed Rate | 13% | 11.50% |

| Fluctuating rate | Prime Rate+0.5% | Prime Rate |

There is difference in the two types of rate offered to the two parties but difference in fixed rate is 1.5% whereas that in fluctuating rate is only 0.5%. This gives rise to scope for interest rate swap which will result into benefit of 1% which can be shared by both by making interest swap as explained below – Prime rate is assumed at 9%.Assume principal amount Rs1,00,000.

Solution:

Step 1 – Overall Gain of Swapping:

Sum of preferred interest rates-sum of opposite interest rates.

We come to know that Interest rate preferred by Mr X is fixed whereas Mr Y is Fluctuating.

But for Mr X, fixed rate is comparatively high when compared with that offered to Mr Y .

The Interest rates as preferred by both the parties will be 13% fixed and Prime Rate 9% as fluctuating. The Interest Rates as opposite to their preference is Prime Rate+0.5% i.e. 9.5% as fluctuating and 11.5% as fixed. CA Final FR FINANCIAL INSTRUMENTS

So sum of preferred rates is 22%.

Sum of opposite rates is 21%.

The Difference between the two 1 is 1% which is the result of swapping which can be shared by both the parties equally as 0.5% each.

Step 2 – Allocation of gain to Parties

Mr X-0.5%

Mr Y-0.5%

Step 3 – Swap Structure for one Party (Mr X).

Mr X should borrow Rs 100000 at the floating interest rate(opposite to his preference) of 9.5% and give the same to Mr Y

Mr Y in Return should repay the interest of 9.5% Rs 100000 to Mr X at the year end.

Step 4 – Net Effective Cost or Gain to One Party.

Mr X?s Preference is fixed rate interest which is available for him at 13%. But by doing interest rate swap his interest rate will come down by 0.5%(Step2). So his net interest outflow will be 12.5%.The loan at this fixed interest rate, he should borrow from another party i.e. Mr Y.

Step 5 – Swap Structure for Mr Y.

At first he should borrow Rs 100000 at the rate opposite to his preference, means he will borrow at 11.5% fixed rate. And he will give the same amount to Mr X at 12.5% Interest Rate.

Later he will borrow from Mr X at 9.5% floating Rate.(Step 3).

By doing all the above:

Net interest outflow to Mr X is 12.5%, which is 0.5% less than the preferred rate.

Net interest outflow to Mr Y is (11.5+9.5-12.5) 8.5%, which is 0.5% less than the given preferred rate of 9%.

Step 6 – Accounting of Receipts and Payments. CA Final FR FINANCIAL INSTRUMENTS

Thanks for reading. This article was written by Naveen Mogaveer & Gazal Gupta. Thanks to both of you from Team CA Study for this valuable contribution.

As stated earlier, we will be coming with more in this series. We will be really happy & encouraged if (in case you really found this article useful) you can leave a comment & share this article with your fellow colleagues as well.

That’s all for now. Stay Connected for more such updates.

Jai Hind, Vande Mataram

Team CA Study

Nice ?

Clear and understandable explanation.